Steal This Commission Model: An Approach to Balancing Profitability and Equitable Pay

by Cory A. Wilson

Overview

Balancing revenue, profit, retention, and pay is one of the most common challenges for businesses across every industry. My work with Enjoy Co. Hair Studio gave me an opportunity to rethink my approach and apply some cross-industry inspiration. Let’s dive in.

One quick note: I’m going to use the terms “employee”, “staff”, “teammate”, and “contractor” interchangeably throughout this article. For the purposes of this conversation, these terms are synonymous.

Four factors to consider

Net Service Revenue – Revenue is the money you have coming in the door, of course. However, products and services often have very specific overhead costs at the point of sale. These costs commonly include the service fees charged by your payment processing company and any discounts applied. Paying commission based on the gross service revenue would result in a significant loss to the business while providing no meaningful (dis)incentive to prevent your team from over-applying discounts or giving freebies.

The net revenue — the revenue after those fees and discounts — is therefore the actual base amount to consider when determining commissions because this is the actual revenue entering your bank account. Net revenue ties actual revenue to wages, ensuring that the profitability of the business is always proportional to the commission paid. We’ll dive into the details of this aspect a little later.

Discounts can be predefined and controlled through platforms such as Square to ensure they are not applied arbitrarily, while allowing leeway for an employee to offer a discount at their discretion, i.e., for friends, family, mistakes, or to appease the occasional dissatisfied customer. If an employee knows that the discount they offer will directly affect their personal bottom line, they will be more likely to exercise responsible judgement, without the need for over-management, while still feeling empowered to ensure that customers receive high-quality service and are satisfied.

Net Product Revenue – Not all services and products are created equal. In the context of a commission model, services have no real calculated overhead. In contrast, products have a very real cost (i.e., the cost of goods). To deal with this reality, services and products should be treated as separate items in our calculations. If all of your products have the same profit margin, then calculating the commissions for net product revenue is simple. If your products have widely variable margins, you may consider creating simple subcategories for product types with similar margins. You may also consider simplifying your margins by rebalancing your prices, if possible. Regardless of how you price your products or how your reports are organized, I always recommend that complexity be reduced. Following the same logic applied for the net service revenue, the commission on product revenue is a percentage of the profit margin, determined after any fees or discounts. This approach ensures that commissions are paid only on the actual margin of the product, rather than the gross cost of the product to the customer.

Rather than applying a straight 10% commission for gross product sales, you could offer a 20% commission on the net product revenue. For example, if a product has a 50% margin, the commission would be $10 on $100 in sales in both scenarios. However, if a product has a 20% margin, the commission on that same $100 transaction would be $4. This approach ensures that profitability is maintained and that the staff is paid accordingly. In general, this commission model also incentivizes the sale of higher-margin products.

Retention and Pay – The challenge of retention is also often the challenge of motivation — which, if we’re truly honest with ourselves, is almost always about pay. Some people are driven to climb ladders, while others are driven to do the best work they can. Some employees love company perks, and some work only to support their lifestyle. Many small and mid-sized companies are so structurally flat (which is not inherently wrong) that there is no meaningful ladder to incentivize retention. And low retention means that the time and money invested in training and onboarding are lost.

Great work should be rewarded but should be measured with a high degree of objectivity to avoid discrepancies (real or perceived) exacerbated by biases and/or favoritism. Perks are a great way to reward teams but must also be meaningful. Low-quality or low-cost perks can be detrimental to morale when they are disproportionate to team effort and overall company success; in some cases, such perks may actually be offensive to an employee.

Paying everyone a flat commission appears consistent; however, this approach offers no incentive for under-performers to improve while simultaneously creating resentment in the high-performers, due to the lack of a substantial reward for their work and results. This resentment is toxic and causes the best and brightest employees to start looking for an exit.

My question is: How can we offer a meaningful reward that incentivizes high-quality work, in which teammates are rewarded in proportion to their actual effort and results, while balancing the overall success of our business?

An innovative solution

I found a solution to these interrelated challenges in a seemingly unlikely venue: video games.

Gamification is a proven method for motivating and incentivizing behaviors. Unlike laws — which incentivize adherence through the threat of punishment — gamification incentivizes behaviors through incremental rewards and reinforces good behavior. My initial contact with gamification occurred earlier in my career through my work with Games for Change, which led me to keep tabs on the evolution of this approach. My inspiration was further informed by work performed with funding from the MacArthur Foundation, a study on behavior change applied to utility bills, and the delicate competitive balance of Activision-Blizzard’s eSports legend: StarCraft 2.

A tiered commission system — in which each level is slightly more difficult to achieve but offers a greater reward — creates an experience similar to that of leveling up in a video game. This approach incentivizes high-quality result-oriented work, with transparency for everyone. A team that successfully uses this approach will completely eliminate resentment and will shift any competition among teammates toward individual performance. With this system, rewards are directly proportional to transparent, objective metrics, further reducing tension between leadership and staff.

As Enjoy Co.’s owner once said to me, “I love that my team gives themselves raises!"

It’s all about balance

The most enjoyable and successful video games are always fair and balanced. When games are not fair and balanced, players, i.e., employees, are quick to give up or even stage a very vocal public revolt.

Balance across tiers in any commission system must include achievable, meaningful, and transparent goals that are relevant to the actual performance of the business. An equitable delivery of this model will ensure that a teammate reaches each level of commission (generally reset on a monthly basis) relative to very specific revenue objectives. As a teammate brings in more revenue and achieves a defined level of commission, the business will give away more of the net revenue while still retaining a greater net dollar amount. In short, paying increasingly higher commissions results in more money for everyone, with no real cost to the business.

This huge incentive should allow you to authentically boast higher commissions over your competitors and therefore increase retention rates for your best and brightest employees. Furthermore, by successfully modeling commission scenarios against historical business performance, you are ensured that the overall health and profitability of the business will be maintained. These systems and approaches can be modified and adapted as your business responds to the reality of the operations and markets over time.

Let’s dive deeper

Define objective metrics – It’s important to define the metrics by which contractors are to be evaluated. For this part of our conversation, I’m going to focus on service metrics.

The most obvious metric is revenue per period (i.e., per month, quarter, or even year). For most service-centric industries (such as stylists and salons), this number alone cannot define the tiers needed for commission levels. We also need to know the average amount per transaction (without tips, where applicable) and the potential range of provided services.

Create meaningful tiers – To create the actual tiers for our commission system, we must first define the bounds of the system. The base should be a reasonable minimum amount that can be expected from an employee in a given time period, while the maximum should be an achievable but challenging ceiling. Each tier should represent a meaningful as well as achievable increase compared to the previous tier.

At Enjoy Co. Hair Studio, we initially defined our minimum expectation as 3 days per week at 7 sessions per day, which corresponded to a 50% commission. Currently, each level up achieved adds an additional 5% to the commission rate, reaching up to 70%. With an average service revenue per session of $40, we calculate the minimum tier as $3,360 in this example. We defined our maximum as 5 days a week at 14 sessions a day, corresponding to $11,200. A contractor could work 6 days in a week with only 12 sessions per day and still achieve that same goal. This flexibility translates across the entire system and accounts for the real-world ebb and flow of day-to-day operations.

Keeping tabs on your metrics is extremely important. After our first full nine months of operation at Enjoy Co., we found that the average service revenue per session had increased. Updating this one factor in our commission model adjusted the tiers to the reality of the business’ success and our transparently communicated expectations. Had this factor remained in its initial state, the tiers would have been too easy to achieve and would have resulted in a disproportionate loss to the business.

Additional metrics and factors – Most businesses have a degree of nuance in their operations that I cannot capture in this post. For the sake of brevity, I will simply point out that this model can be adjusted to account for larger timescales, can be applied in addition to a base salary, and can include line items for “fees” (such as a cleaning fee or additional resources supplied by the business).

Implementing an easy-to-manage system

Lastly, the system must be simple to implement and manage. I recommend creating standardized report templates from whatever systems you’re using. The report should allow you to quickly find the appropriate inputs that are needed.

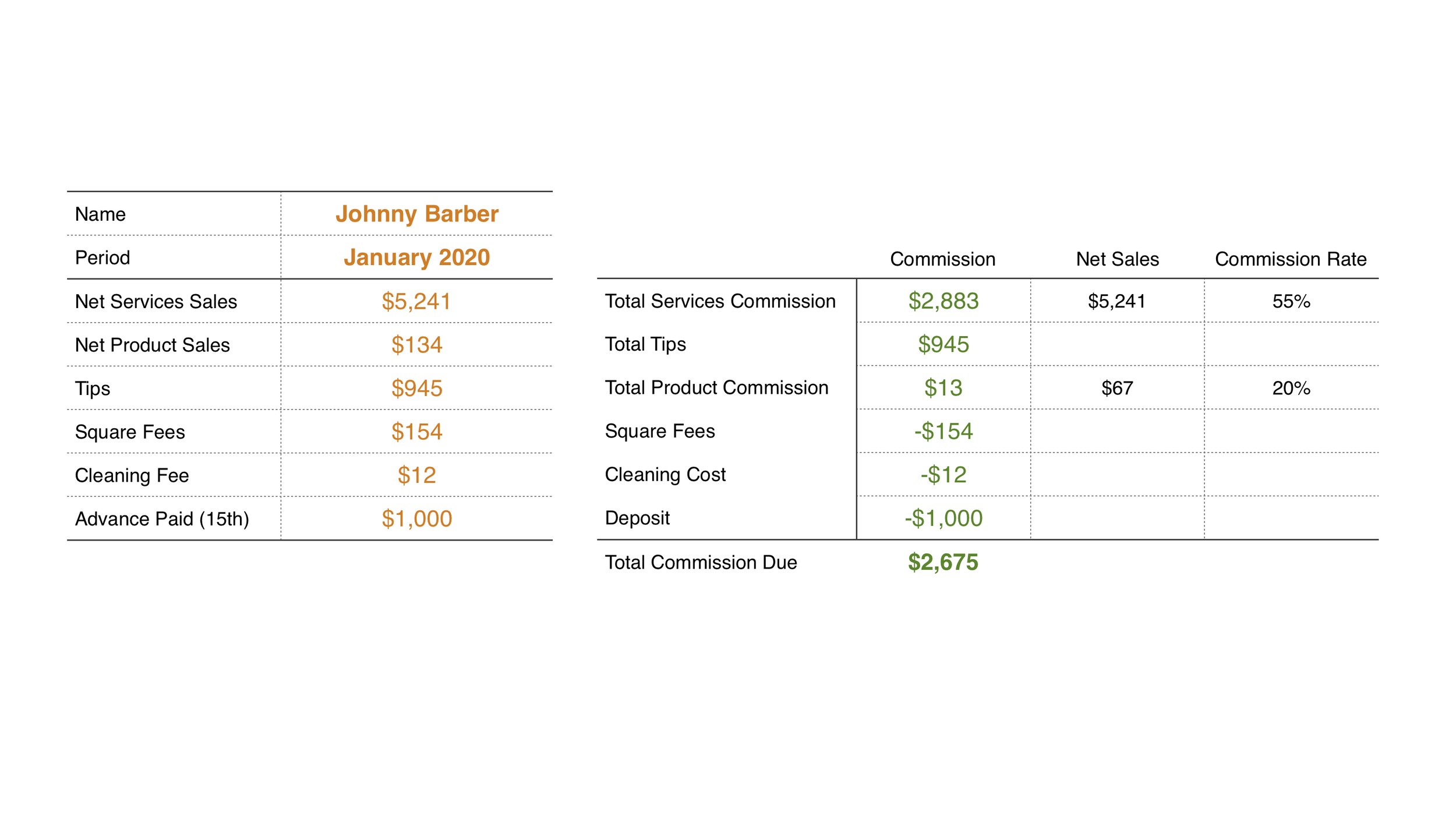

For Enjoy Co., I created a straightforward spreadsheet that could easily be saved as a PDF and shared with each teammate at the end of each month. Our commission report includes the revenue brought in by each contractor as well as tips, cleaning fees, and advances. I also implemented a fairly simple if/then statement to determine the appropriate commission level based on the revenue input, in order to reduce human error. All one has to do is enter the correct information, and then, the sheet spits out the answer.

Hire The Collaborative to plan, implement, and improve your systems and workflows ☀️

Our team loves systems and process challenges. We help refine workflows, train you on best practices, and implement new apps. Connect with us to learn more!